Dividends are a payment of profit from your Limited company to you the owner. Put another way, dividends are the payments from the company to its shareholder/s after all of the company’s costs and taxes are paid for.

Dividends are paid to shareholders in the same proportion as the shares are owned. For the purposes of this article, we will assume that your company has one owner and shareholder, you the contractor and so you would receive 100% of each dividend paid.

How do you declare a dividend?

Dividends must be declared with a dividend voucher. A ‘directors meeting’ will need to be held (even if it is just yourself as the shareholder!) to agree on a dividend declaration and record minutes of the meeting. Many online accounting software’s. like FreeAgent now produce dividend vouchers for your records. These vouchers should be retained for reference should HMRC ever ask to see them. If not declared properly a dividend can be deemed as unlawful.

How often should you take a dividend?

You can take a dividend as often as you like, assuming the company has the profits to cover it, however you shouldn’t be using the company bank account like a personal account and treating regular small personal payments and withdrawals as dividends. Dividends should be planned and best practice would be to take dividends on a quarterly or monthly basis having assessed the company’s financial position.

What is the advantage of dividends and how are they taxed?

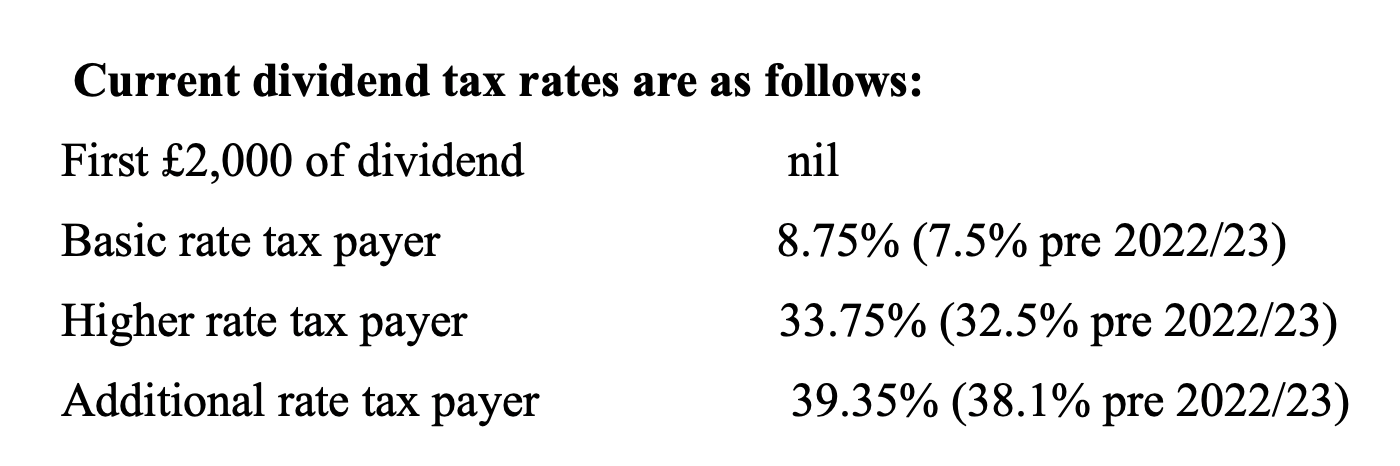

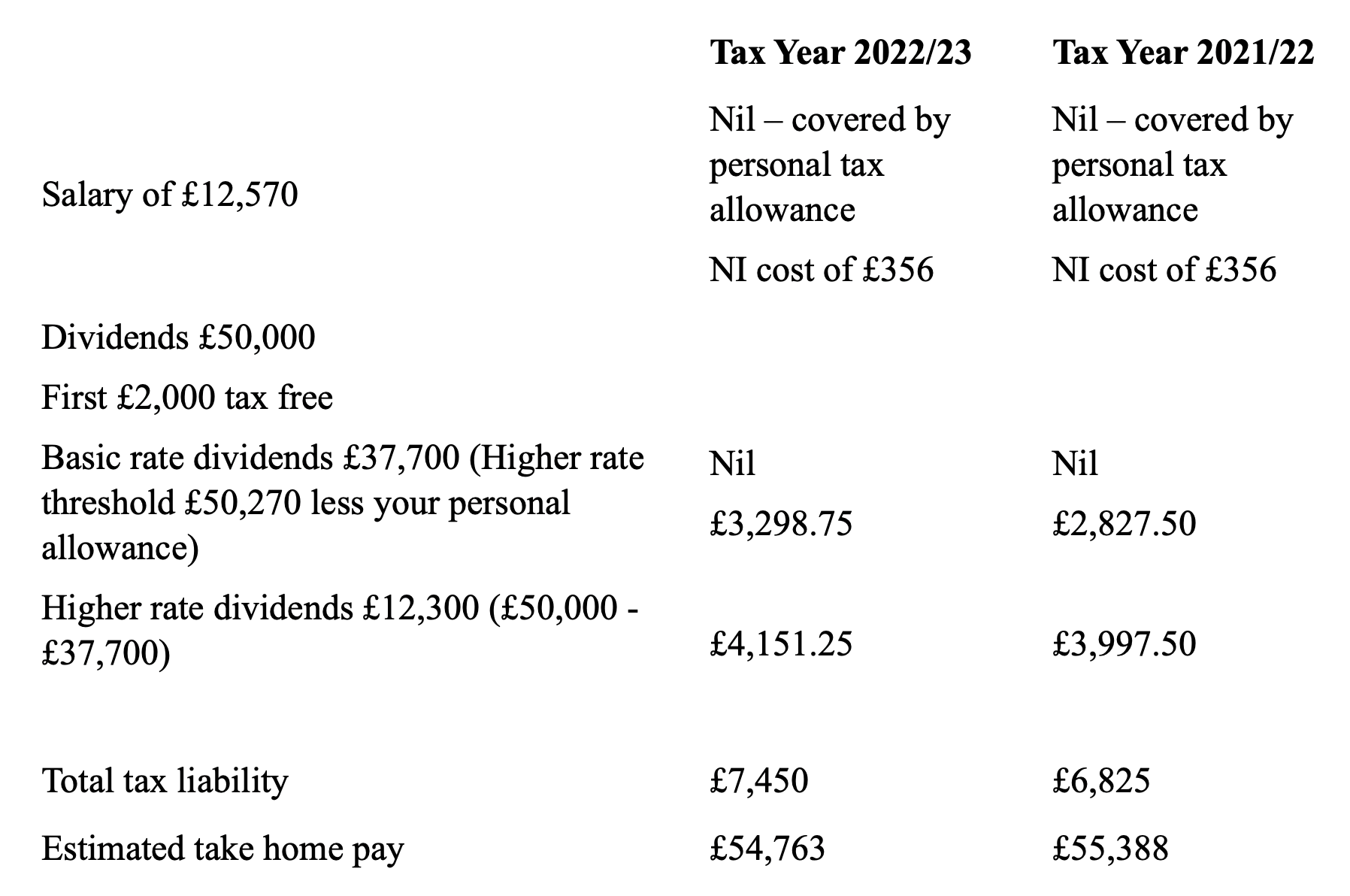

Dividends do not attract a National Insurance charge and despite the recently increased tax rates, the rates chargeable are lower than those on other income. In addition to your annual personal allowance for Income Tax the first £2,000 of dividend income is also tax free.

So, despite the increased tax costs associated with the dividend tax rise, this combination of salary and dividends still delivers a higher take home than salary alone. As a comparison a salary of £50,000 for an individual with a full personal allowance would attract a tax bill of £7,486, marginally in excess of the taxes stated above, but in addition there would be an NI bill of around £5,300, reducing take home pay to around £37,000 for the year.

Musial Accounting Services clients regularly get their accounts reviewed to see if they have optimised their financial structure and how they run their business in order to minimise their tax liability.